Georgia #9 Best State to Startup an LLC

Tuesday, July 18th, 2023

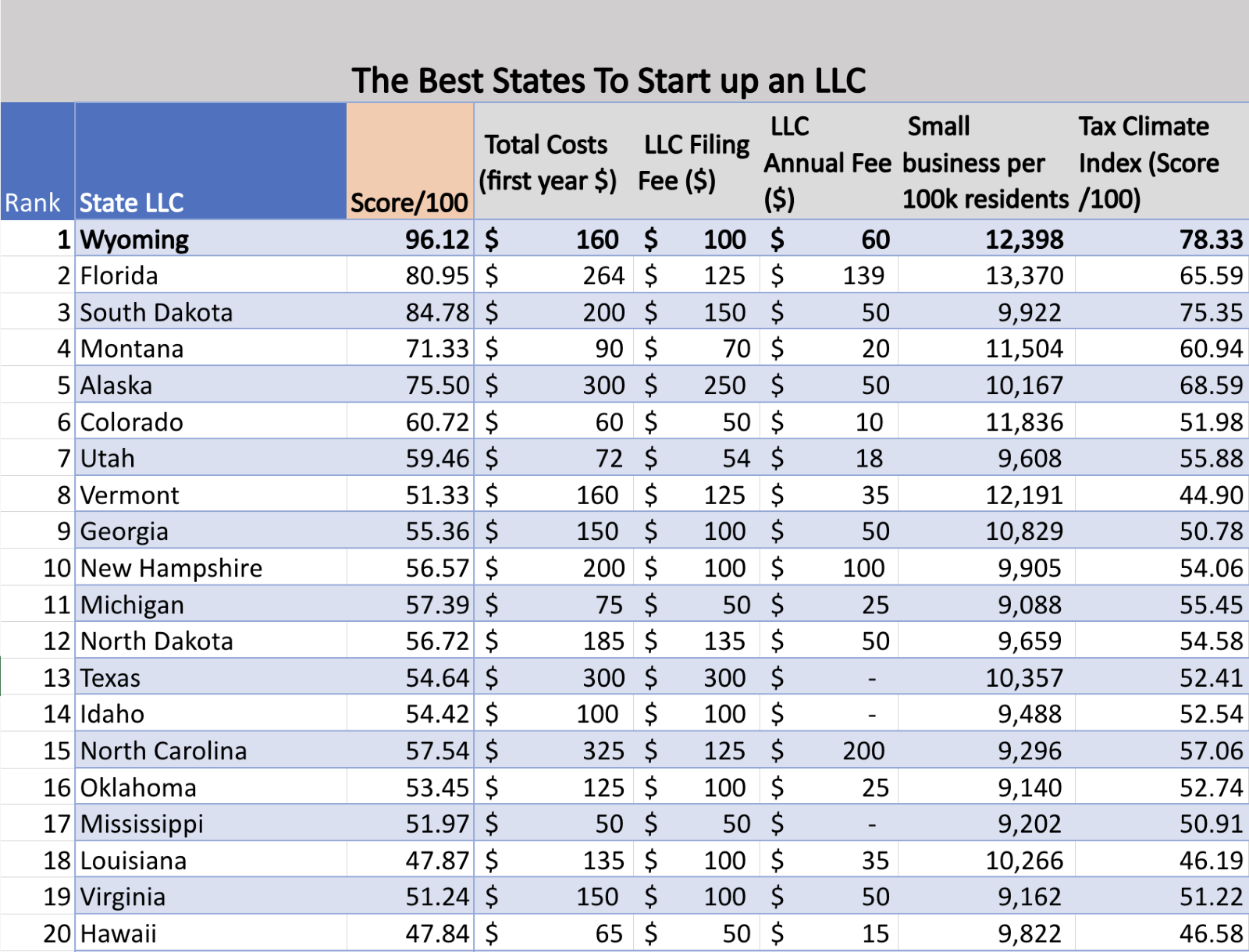

Brand new research conducted by small business advice company Venture Smarter reveals the best and worst states to start up an LLC.

The experts have indexed all 50 U.S states (plus DC), ranking each against six factors necessary for starting up an LLC, to receive a score out of 100.

Rankings are based on factors including LLC annual fees, LLC filling fees, average LLC agreement bid costs (from professional in States required to have one), advertising and publishing costs, tax climate index scores, and number of small businesses per 100K residents.

The best and worst rankings are as follows:

Wyoming tops the rankings, receiving a score of 96.12 out of 100, the total LLC startup costs for the first year are $160 – making it the least expensive state to start up an LLC.

Wyoming’s tax climate index score is 78.33 out of 100, with an annual LLC fee of $60 and an LLC filling fee of $100. There are currently around 12,398 small businesses in Wyoming.

Entrepreneurs looking to setup an LLC in Wyoming do not need to pay LLC Agreement bid costs or advertising costs for publishing and certificate of publication.

Second in the study is Florida, scoring 80.95 out of 100. Whilst Florida’s tax climate index score is 65.59 out of 100, the state currently has around 13,370 small businesses.

Florida’s total LLC startup costs are a total of $264, with $125 of the LLC filling fee and $139 for the annual LLC fee.

Entrepreneurs looking to set up an LLC in Florida also do not need to pay LLC Agreement bid costs or advertising costs for publishing and certificate of publication.

Placing third is South Dakota, achieving a score of 84.78 out of 100. South Dakota has a good tax climate index score of 75.35 with total startup costs at $200.

LLC filling fees in South Dakota are $150, whilst LLC annual fees are $50!

Rounding out the top 10 is; Montana, Alaska, Colorado, Utah, Vermont, Georgia and New Hampshire.

California is the worst state to set up an LLC. Scoring 18.46 out of 100, the total cost for the first year for an LLC in California is $1,950. California has 10,870 small businesses per 100K residents and a tax climate index score of 36.85.

The second worst state is New York, scoring 17.49 out of 100. Total LLC startup costs in New York are $1,985.

Whilst the LLC Filling fee is only $200 and the LLC annual fee is $5, those wanting to startup in New York are required to pay an average $1,030 for an LLC Operating

Agreement and $750 on advertising costs for publishing and certificate of publication.

Ranking third worst is Delaware, scoring 40.91 out of 100, total startup costs are around $1,210. Delaware also requires an LLC Operating Agreement certificate, costing around $820.

A spokesperson for Venture Smarter has commented on the study findings:

“Forming a limited liability company (LLC) in Wyoming can be a great way to protect your assets. The state is one of the most business-friendly states in America, and forming a limited liability company is relatively easy.

“Creating an LLC in Florida is also an easy process, whether it is your first time, or you are an experienced entrepreneur. Any business entity needs its name. It is important to always look up an LLC in Florida and see if the chosen name is available.

“An LLC is a business entity designed to protect its owners from being held personally liable for business-related debts and LLCs have gained popularity because they offer a lot of flexibility for their owners.

“One of the benefits of running an LLC is that the income and losses from the business can ‘pass through’ to the individual owners.

“This means that the LLC itself does not pay any federal taxes on its income. Instead, the business income and losses are passed through to the individual owners.

“Pass-through taxation is a type of taxation in which the taxpayer does not make payments directly to the government but instead pays taxes on LLC income that has already been redistributed across society either as wages or other forms of investment return.”

It is important to understand the most common types of federal tax entities that apply to LLCs. These include:

- The federal income taxes

- Employment taxes (including Social Security and Medicare)

- Federal excise tax on certain items such as alcohol or cigarettes

- Federal income tax for self-employed individuals (the "self-employment tax")

- Franchise tax in some states

Below, the business experts at Venture Smarter have shared five steps to help someone looking at setting up an LLC.

1. Choose A Unique Name for Your LLC

Choosing a suitable business name for your LLC is an essential first step in starting your business.

It is important to choose a name with no patent or not taken by other entities in the state where you plan to register.

To check this, you can search for the name availability on the state's business name database and the U.S. Patent and Trademark Office's database.

Furthermore, choose a name that accurately reflects your business's products or services, and that is easy to remember and pronounce.

Also, ensure your business name isn’t prohibited by the law from being registered. For example, in most states, you’re not allowed to use "bank" in a business name.

"Co" or "Company" can only be used in business names if they follow the naming standards of that state.

Using any variation of words such as "Enterprises," Inc., and Co. is not allowed, and you can’t use any name resembling government entities like State Department, IRS, etc.

2. Choose the State for your LLC

The next step after selecting a name is to choose the state where you want to form your limited liability company. Based on the state you've chosen, the cost to start an LLC will be different.

Most businesses choose a state where they're located, but there are some exceptions.

For example, if you're planning to do business in multiple states, you may look for a state with favorable tax laws and business regulations.

Remember that each state’s requirements and procedure for forming an LLC are different, so it is recommended to research the specific rules for your chosen state.

You will normally need to file Articles of Organization and pay a filing fee to register your LLC with the state. Some states may also require you to publish a notice of your LLC formation in a local newspaper.

3. Nominate a registered agent

Everyone looking to start an LLC must choose a registered agent.

A registered agent is the representative of your company who is designated to handle legal and administrative documents on your LLC’s behalf. This includes important documents like tax forms and lawsuits.

Your registered agent must have a physical address in the state where your LLC is formed and be available during regular business hours.

You can choose to be your own registered agent; however, this may not be the most convenient option if you keep moving or changing addresses frequently.

4. Get articles of organization for your LLC

For your LLC to become a legal business entity, there are some legal documents you must file with the state agency through your registered agent.

One of those documents is called Articles of Organization, also known as a Certificate of Formation in different states.

Certificate of Formation (or Organization) is one of two documents filed with the SOS or other designated person for an LLC to become legal and recognized by law as a separate entity from its members and managers.

To file the Articles of Organization, you’ll be required to provide a filing fee and submit the document to the Secretary of State's office in the state where your LLC is formed.

The second document needed describes the company's capital business structure and rights.

5. Create an LLC Operating Agreement

Operating agreements are documents that govern the operations and management of an LLC. Although not a basic requirement by law, it is highly recommended that LLCs create one.

These agreements contain operating rules for the LLC members or owners, capital contributions, and buy-sell arrangements, among other things.

This way, it can help avoid conflicts and misunderstandings between members by clearly defining expectations and responsibilities.

Operating agreements also protect your LLC's limited liability status, by demonstrating that your LLC is a separate legal entity from the small business owners.

In most cases, the law automatically enforces operating agreements. Therefore, it is important it is always drafted properly.

Consulting an attorney before making any final decisions is a good way to get any advice you on how to set up your business and what kind of license law requires.

To summarise, all elements required to form an LLC include:

-

- The business name of your LLC

-

- The registered agent's name and address

-

- A statement about who is in charge (members, managers, or both)

-

- The purpose of the business

-

- The date it was filed with the SOS or other designated person

-

- The name and address of a person to contact for more information about the Articles

-

- Additional provisions agreed upon